can you look up a tax exempt certificate

If you cannot remember whether you registered your business using your own name or your business name conduct your search in multiple ways selecting the option that allows you to search for a name that includes. The organization may have applied to the IRS for recognition of exemption and been recognized by the IRS as tax-exempt after its effective date of automatic revocation.

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

Purchasers requesting sales tax exemption on the basis of diplomatic or consular status must circle number 20 for Other and write in Diplomatic Mission for both Personal and Mission-related expenses.

/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)

. Verification of tax-exempt resale certificate can be carried out through the official Alabama State website. Sellers should exclude from taxable sales price the transactions for which they have accepted an exemption certificate from a purchaser as described below. Search and obtain online verification of nonprofit and other types of organizations that hold state tax exemption from Sales and Use Tax Franchise Tax and Hotel Occupancy Tax.

Online Verification of Maryland Tax Account Numbers. Form 990 Series Returns. In order to access a copy of your original 1023 EZ form you will need to log in to your account click on My Account in the upper right-hand corner of the screen and then click on My Forms This page will list any forms submitted through your account.

Exemption certificates are signed by purchasers and are given to sellers to verify that a transaction is exempt. A holistic process one that incorporates transacting party information your companys nexus footprint. Enter your name or the name of your business.

You can find out if the exemption status has been reinstated by reviewing the Pub. Another way to check the tax-exempt status of a company or organization is to call the IRS directly at 1-877-829-5500. Although you cannot search by tax exempt number you can search by the organization and location.

In New York for instance you may use an exemption certificate if as a purchaser you intend to resell the property or service. Tax Exempt Organization Search Tool. You can get those details from the tax exemption certificate the buyer will provide you and its details must match their invoice details.

ST-11A for more information about Form ST-11A please call 804367-8037 Semiconductor Manufacturing. Cleanrooms equipment fuel power energy and supplies used in the manufacture or processing of semiconductors are not subject to sales tax. You can check an organizations eligibility to receive tax-deductible charitable contributions Pub 78 Data.

How to Verify a Resale Certificate in Every State. Alabama Login required. Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify.

Sellers must retain copies of the exemption certificates. 78 Data for 501c3 organizations or reviewing its determination letter which would show an effective date on or after the automatic revocation date with the online tool or the bulk data download files. Vendors are often confronted with customers who wish to make purchases tax free either because they intend to resell the item or because they are making a purchase for a non-profit organization an individual or a business possessing a valid Tennessee certificate of exemption.

How to get a tax exempt certificate will vary by state and will depend on the type of certificate you want to obtain. 13 rows Introduction. When accepting a resale or tax exemption certificate it is important to ensure that a buyer provides you with a valid document.

Sales Tax Exemption Certificates for Governmental Entities. To be eligible for the exemption Florida law requires that political subdivisions obtain a sales tax Consumers. Vendors are often confronted with customers who wish to make purchases tax free either because they intend to resell the item or because the customers are making a purchase for a non-profit organization an individual or a business possessing a valid Tennessee certificate of exemption.

Form 990-N e-Postcard Pub. Choose Search and you will be brought to a list of organizations. Benefits of Tax-Exempt Status.

An exemption certificate is the form presented by an exempt organization or individual to the seller when making a tax-exempt purchase. Exemptions are based on the customer making the purchase and always require documentation. Businesses are often confronted with customers who wish to make purchases tax free either because they intend to resell the item and charge the sales tax or because they are making a purchase for an organization possessing a tax exempt card issued by the State Comptrollers Office.

Your Kansas Tax Registration Number 000-0000000000-00. An IRS agent will look up an entitys status for you if. Sales and Use Tax Exemption Verification Application.

You may also review the EO BMF Extract to check the organizations current exempt status. You can also search for information about an organizations tax-exempt status and filings. Look for a line that says Streamlined Application for Recognition of Exemption Under.

You can verify that the organization is a tax exempt non-profit organization. You may also contact the Internal Revenue Service at 877829-5500 and ask that they verify the. Statewide group organizations might have one listing with All Branches as the city rather than a separate listing for each.

Information on how to verify sales and. Choose the option that enables you to search by the business name or the owners name. Arkansas Use either the resellers permit ID number or Streamlined Sales Tax number.

Tax-exempt certificates act as proof that a business or organization is not required to pay sales tax or is purchasing items that will be used in a way that makes them tax-exempt. A purchaser must give the seller the properly. From there click the Start Over button Business Verify an Exemption Certificate.

Sales and Use Tax Certificate Verification Application. Intend to use the property or service for a purpose that is exempt from sales tax. Sales tax exemption certificates enable a purchaser to make tax-free purchases.

The required information is Taxpayer ID Type Taxpayer ID and Exempt Sales Account Number. Automatic Revocation of Exemption List. There are different types of exempt.

Or you make purchases as an agent or employee of tax-exempt nonprofit organizations or government entities. Due diligence can require verification of tax registration numbers and confirmation that existing validation processes are setup correctly. Complete the Type of Business Section.

Florida law grants governmental entities including states counties municipalities and political subdivisions eg school districts or municipal libraries an exemption from Florida sales and use tax. To check whether an organization is currently recognized by the IRS as tax-exempt call Customer Account Services at 877 829-5500 toll-free number. Number should have 8 digits.

Different purchasers may be granted exemptions under a states statutes. Arizona Enter the number here. Additional Information for new users.

Sales and use tax.

Resale Certificate Request Letter Template 11 Templates Example Templates Example Letter Templates Certificate Templates Business Plan Template

/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)

Form 990 Return Of Organization Exempt From Income Tax Definition

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

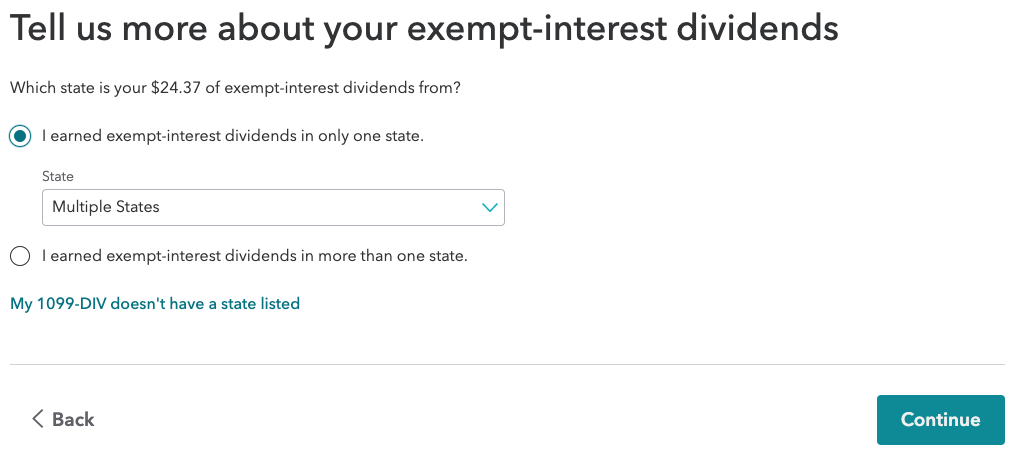

How Do I Address Exempt Interest Dividends In My Tax Return Or Tax Software Wealthfront Support

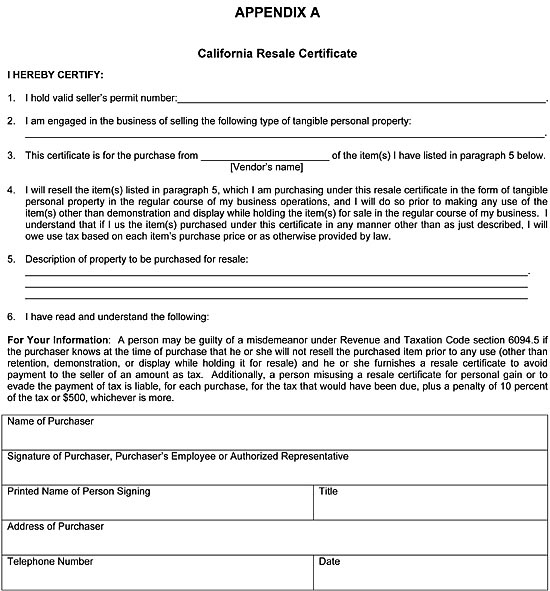

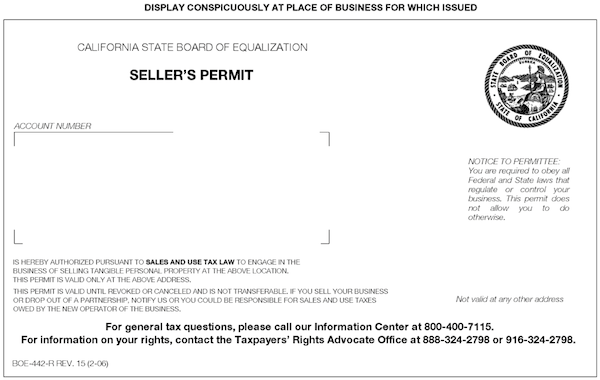

Sellers Permit Vs Resale Certificate Mcclellan Davis Llc

How Do I Know If I Am Exempt From Federal Withholding

Sellers Permit Vs Resale Certificate Mcclellan Davis Llc

What Is Ein How To Get Ein For Nonprofit 501c3 Organization

Tax Exempt Meaning Examples Organizations How It Works

Do I Have To Pay Sales Tax What If I Am Tax Exempt Techsmith Support

How To Get A Resale Certificate In Texas Startingyourbusiness Com

Dor Foreign Diplomat Tax Exemption Cards

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Printable California Sales Tax Exemption Certificates

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

Sales Tax Exemption For Building Materials Used In State Construction Projects